Solar EMI & Loans in 2026: The Complete Financial Guide for Tamil Nadu

It is 2026. Solar panels are no longer a luxury "nice-to-have" gadget for the wealthy. They are a standard home utility, just like your water connection or internet.

Yet, one barrier remains for many families in Cuddalore: The Upfront Cost. A high-quality 3kW system costs between ₹1.8L to ₹2.1L. Even with the ₹78,000 subsidy, finding the balance ₹1.2 Lakhs in cash can be difficult.

Here is the secret: You don't need cash. In fact, financial exerts argue you shouldn't pay cash for solar. Why? Because solar is one of the few assets on earth that pays for its own loan.

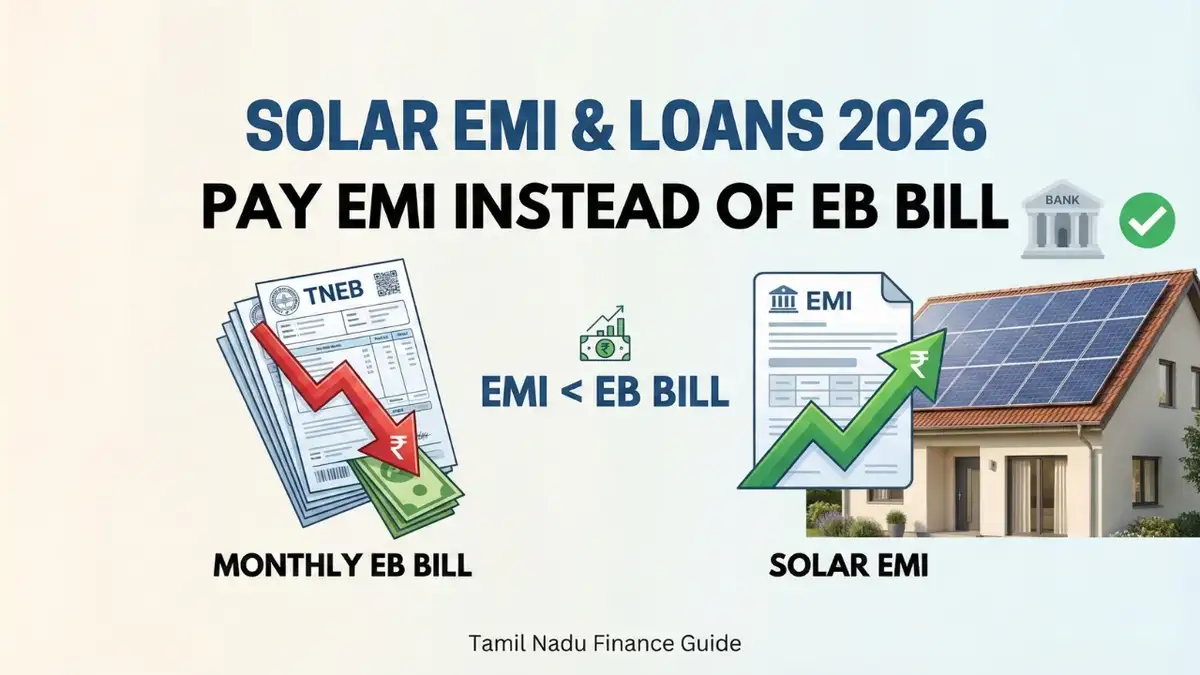

In this comprehensive 2026 guide, we explore the landscape of Solar Loans (Green Finance) in Tamil Nadu. We will show you how to swap your "Forever TNEB Bill" for a temporary "Bank EMI" that actually saves you money every month.

The "Zero-Cost" Strategy: Understanding Cash Flow

Most people view a loan as a burden. But a Solar Loan is different. It is an Asset-Backed Loan.

Let's do the math for a standard 3kW System in 2026:

The Old Reality (Status Quo)

- You pay TNEB: ₹3,000 / month (avg)

- Asset Created: Zero

- Cost after 5 years: ₹1,80,000 (Money burnt)

- Result: You are poorer, and you own nothing.

The Solar Loan Reality

- Net System Cost: ₹1,20,000 (After ₹78k Subsidy deduction)

- Loan Amount: ₹1,00,000 (Down payment ₹20k)

- Interest Rate: ~8.5%

- Loan Tenure: 5 Years

- Monthly EMI: ~₹2,050

The Comparison

- You stop paying TNEB ₹3,000.

- You start paying Bank ₹2,050.

- Monthly Profit: ₹950 (Savings in your pocket)

- Asset Created: You OWN a power plant guaranteed for 25 years.

- After 5 Years: EMI becomes ₹0. Savings jump to ₹3000+.

The Verdict: You are not spending "extra" money. You are simply redirecting a smaller portion of your electricity bill to the bank to build equity.

Top Banks for Solar Loans in Tamil Nadu (2026 Deep Dive)

Government and Private banks have aggressive targets for "Green Lending" in 2026. Here is the landscape for borrowers in Cuddalore.

1. State Bank of India (SBI) - "PM Surya Ghar Loan"

SBI is the aggressive market leader. Their system is integrated directly with the National Portal.

- Interest Rate: Extremely competitive (Repo linked, typically 7% - 8.5% depending on CIBIL).

- Loan Amount: Up to 90% of the project cost.

- Tenure: Up to 10 years (Longest tenure lowers your EMI further).

- Processing Fee: Waived for loans under PM Surya Ghar scheme (check specific branch offers).

- Best For: Salaried individuals with salary accounts in SBI.

2. Union Bank of India - "Union Solar"

Union Bank has a massive branch network in Cuddalore District.

- Eligibility: Salaried (Min income ₹15k/month) or Business (ITR required).

- LTV Ratio: They fund up to 80-85% of the quotation value.

- Speed: Known for faster processing than SBI in some rural branches.

- Collateral: Usually nil for loans up to ₹10 Lakhs (covered under CGFMU).

3. Canara Bank - "Canara Solar"

A favorite for pensioners and government employees in Tamil Nadu.

- Margin: You usually pay 10-20% margin money.

- Security: The solar panels/inverter are hypothecated.

- Pre-Closure: Usually zero penalty if you pay off the loan early from your own sources.

4. Indian Bank - "IB Roof Solar"

Very strong locally in Tamil Nadu.

- Interest Rate: Competitive, linked to RLLR.

- Target: Existing home loan customers get instant approval as a "Top Up Loan".

Financial Pitfalls: Watch Out for These Hidden Costs

While interest rates grab headlines, the "Real Cost" of a loan includes hidden fees. When you visit the bank, ask these questions:

- Processing Fees: Some private banks charge 1-2% + GST. Nationalized banks often waive this for green loans. Negotiate this!

- Insurance: Banks often bundle "Loan Shield" insurance. Check if this is mandatory.

- Documentation Charges: Legal opinion and valuation charges. (Usually not applicable for small unsecured solar loans, but standard for Home Loan Top-ups).

- Floating vs. Fixed: Most solar loans are floating rate. If RBI increases rates, your tenure might extend.

The Documentation Checklist (2026)

To get approved in 48 hours, walk into the branch with this exact file:

- KYC: Aadhar Card, PAN Card, Voter ID.

- Income Proof (Salaried): Last 3 months payslips + 6 months bank statement.

- Income Proof (Business): Last 2 years IT Returns + P&L / Balance Sheet.

- Electricity Bill: Latest bill (Must serve as address proof).

- Ownership Proof: Property Tax receipt / Sale Deed copy (just to prove ownership).

- The Quotation: A valid

Proforma Invoicefrom a Certified Installer (that's us!).- Note: Banks reject handwritten quotes. You need a GST-compliant digital quotation.

The Loan Process: From Quote to Installation

How does it actually work? Do you get the cash?

- Site Visit & Quote: Surya's Solar engineers visit your home, design the system, and give you a generated "Bank-Ready Quotation".

- Bank Submission: You submit this quote + docs to your branch manager.

- Sanction Letter: The bank approves the loan and issues a letter.

- Margin Money: You pay your share (e.g., 20%) to Surya's Solar.

- Disbursement: The bank pays the remaining 80% directly to Surya's Solar (Vendor). They rarely give cash to the customer.

- Installation: We install the system immediately upon receiving the Payment Advice.

- Subsidy: Once the system is live, the Govt Subsidy (₹78k) hits your account. You can use this to prepay part of the loan immediately!

Warning: "Home Loan Top-Up" vs. "Solar Loan"

If you already have a Home Loan running, the Top-Up is often better.

- Why? Lower interest rates (same as home loan).

- Tenure? Can be spread over 15-20 years (Tiny EMI).

- Paperwork? Almost zero (Bank already has your deeds).

Ask your Home Loan provider for a "Top Up for Home Improvement/Solar".

Ready to Finance Your Freedom?

In 2026, money is not the constraint. Information is. A solar loan allows you to own a power plant for less than the cost of your monthly electric bill.

At Surya's Solar, we have relationships with local branch managers in Cuddalore. We help prepare your project report to ensure smooth loan processing.

Don't wait to save up cash. Save while you pay.

Request a Bank-Ready Quotation today and start your journey to energy independence.

Disclaimer: Interest rates and loan terms mentioned are indicative of January 2026 market trends and subject to change by respective banks. Please verify with your branch.

Need Help With Solar Financing?

We partner with leading banks for solar loans. Get instant EMI quotes and pre-approved loan offers with minimal documentation.

Frequently Asked Questions

What's the minimum CIBIL score needed for a solar loan?

Can I get a loan if I'm self-employed?

Is the interest tax-deductible?

Can I prepay the loan without penalty?

What if I sell the house before the loan is paid off?

Related Articles

- PM Surya Ghar Subsidy - Reduce loan amount with subsidy

- Tax Benefits for Business - 40% depreciation benefits

- Solar ROI Analysis - Full financial breakdown

Get a Free Rooftop Assessment

Our engineers will visit your site, analyze shadow-free area, and provide a detailed solar report.

Book Free AssessmentTags

Ready to Switch to Solar?

Get a customized solar solution for your home. Save up to 90% on electricity bills!

- Free Site Visit

- Govt. Subsidy Support

- 25 Years Warranty